One thing we all have in common is the desire to be “good with money” and always have enough funds. The first step to reaching your financial aims is to know yourself. It includes understanding when and how you spend your personal finances.

This process may take some time but it’s not rocket science. Keep on reading to learn exactly why and how you should track your spending to improve your life and achieve your goals.

Tracking Your Spending

This process involves defining your expenses throughout the money. This is an important activity that should be done regularly (preferably each month). Once you start tracking your expenditures, you may feel overwhelmed as you know little about them. But as time goes by, you will gain more understanding of this process and why it’s essential for your financial stability.

Those who keep tracking their spending continuously claim that they gradually learn how to do it with minimal effort. You don’t necessarily need to start tracking your costs in order to cut them down. The best part of this process is that every consumer can take it as far as they want. If you believe you aren’t ready to trim your expenses straight away, you may just use this option to record where your income goes and how well you manage your funds.

Main Reasons to Keep Track of Spending

If you begin to monitor your expenditures every month, you will become more responsible for your personal finances and learn how to spend money wisely. This is a significant habit as not many Canadians know how to manage their finances these days and often rely on online payday loans Vancouver to receive additional money will the next salary day.

It Helps You Stick to the Monthly Budget

Once you set up your monthly budget, you will have a defined plan for your monthly spending. This plan will contain information about your expenses as well as income. Having several spending categories and writing down the expenses for each of them will help you understand when to stop wasting your cash. At the end of the month, you will be able to check how much you’ve earned versus how much you’ve spent.

In case of overspending, you may search for categories that may be lowered. Make certain you spend enough on debt repayment and put aside some funds into your savings account. Anyway, once you start tracking your costs you will be able to make the necessary adjustments and changes to your budget so that you maximize your savings next month and avoid overspending.

It Can Show Spending Problems

This is another reason for keeping a budget and managing your spending. You will determine your expenses throughout each month to learn more about your spending habits. Many people don’t really know where their income goes and why there is nothing left by the end of the month.

Negative spending habits are a common reason for having financial issues. You may end up finding the categories of unnecessary spending such as paying for a gym membership if you don’t attend it, or other subscriptions that might be canceled. You may find out that you waste several hundred dollars on entertainment, eating out, or buying designer clothes. It will show you if some expenditures may be trimmed to help you overcome monetary difficulties and avoid debt.

It Helps to Reach Your Financial Aims

Another reason is the ability to achieve your monetary goals if your budget and track your spending. Each consumer may have a different financial aim. Whether you are planning to get rid of debt, build an emergency fund, save for a vacation, or put more money in your retirement fund, you are more likely to reach these targets if you have a savings plan and manage your expenses. For instance, if you want to go on a vacation this year, you should include monthly savings in your budget.

How Exactly to Track Your Spending

Step 1: The Basics

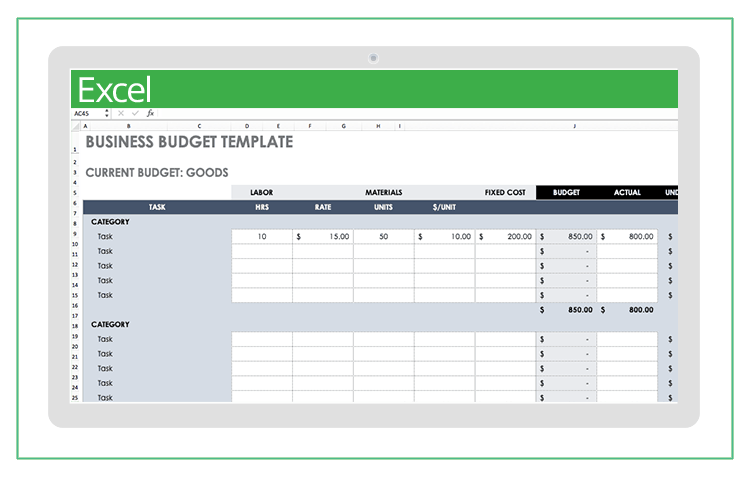

You may want to start tracking your expenses on a spreadsheet, write them down on paper, or use Excel tables. Whatever option you choose, there is no need to go into too many details about how you should make it. You may start with having three columns: what you earned, what you spent, and what you saved. It will give you an overview of where your income goes and how well you manage your personal finances.

Step 2: Make a Budget

Whether you are planning an upcoming vacation or want to save some funds for the Christmas holiday season, you should make a monthly budget to see your real-life savings and spending. Having the numbers will help you build a strict plan on how to spend your salary to reach these goals. You will be able to notice what areas and categories of your spending should be lowered.

Step 3: Set Up Automatic Tracking

It’s okay to write down all your expenses and savings if you are used to it. However, it may not be very convenient to go through your written spreadsheets to check your spending and how it improved over time. It takes a lot of time and effort to write everything down. Using Excel tables can be beneficial and more useful for this purpose. Using automatic spreadsheets online is more flexible and takes less time.

The Bottom Line

One of the most important strategies for tracking your expenses is to be consistent and keep doing it no matter what. You may see that you overspend in several categories and decide to stop tracking your spending till the next month.

However, if you stay focused and organized and continue managing your finances at least for several months in a row, you will be able to notice changes. You will also reveal what you are doing wrong and how to prevent it. It takes only several minutes every day to track your costs, but it is totally worth it.

Ingrid Maldine is a business writer, editor and management consultant with extensive experience writing and consulting for both start-ups and long established companies. She has ten years management and leadership experience gained at BSkyB in London and Viva Travel Guides in Quito, Ecuador, giving her a depth of insight into innovation in international business. With an MBA from the University of Hull and many years of experience running her own business consultancy, Ingrid’s background allows her to connect with a diverse range of clients, including cutting edge technology and web-based start-ups but also multinationals in need of assistance. Ingrid has played a defining role in shaping organizational strategy for a wide range of different organizations, including for-profit, NGOs and charities. Ingrid has also served on the Board of Directors for the South American Explorers Club in Quito, Ecuador.