The first thing for small business owners to understand about tax avoidance is that it’s something HMRC takes extremely seriously.

Specifically, in the last two years they’ve been successful in winning 90% of tax avoidance cases that have gone before the courts.

In the recent Cyclops Electrics case, Penny Ciniewicz, Director General of HMRC’s Customer Compliance Group, said: “We cannot allow tax avoidance schemes like these to deprive the UK of vital revenue. The money we’ve protected in this case alone would be enough to pay the annual salaries of around 2,400 newly qualified teachers.

“The honest majority of people who pay their taxes shouldn’t have to carry the burden of paying for the public services we need.”

With that in mind, it’s so important small businesses have complete clarity when it comes to the issue of tax avoidance.

Solutions Loans are helping tackle this issue with the creation of a detailed guide as to what businesses should look for when it comes to tax avoidance.

They’ve highlighted eight things to be aware of when analysing their own affairs, which include:

- If it is complex and involves multiple transactions purely for the reasons of avoiding tax

- If it sounds too good to be true (i.e. for no real effort or reason you avoid paying tax)

- There is no real economic activity or risk involved (such as an investment)

- The scheme consists of money going around in a circle through other businesses or intermediaries

- A third party or the scheme’s promoter provides funds to make the scheme work

- Known tax havens are involved

- Offshore companies are involved (or offshore trusts)

- There are confidentiality requirements

While it’s important for businesses to know the kinds of things they should be looking out for, Solution Loans have also provided more detailed information on three types of schemes that have been deemed tax avoidance.

They include the following:

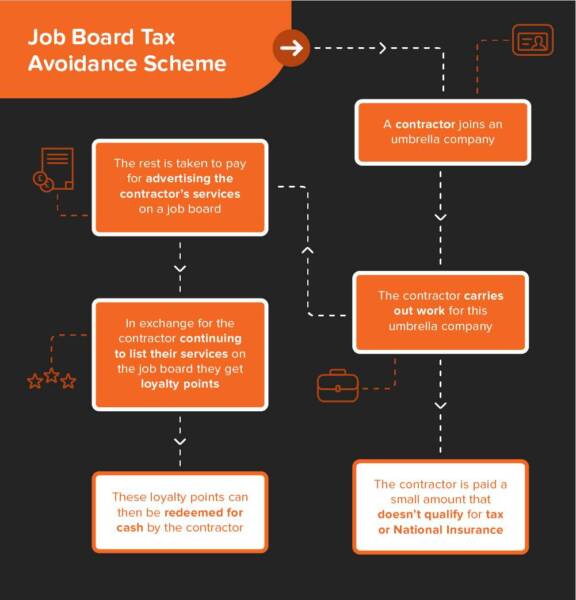

- Job Board Tax Avoidance Schemes

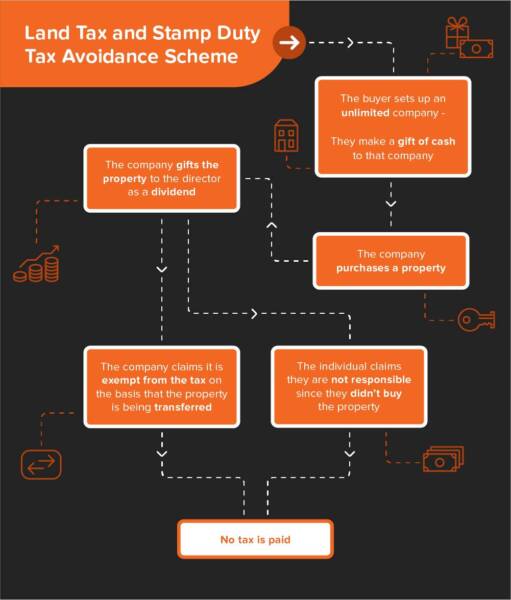

- Land Tax and Stamp Duty Tax Avoidance Schemes

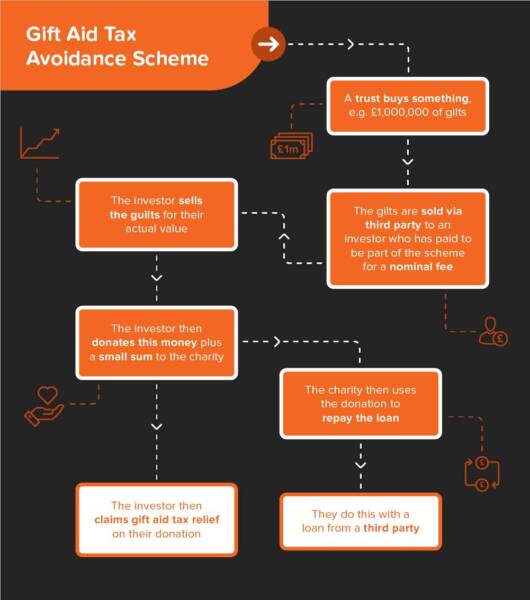

- Gift Aid Tax Avoidance Schemes

And here’s what you should be looking out for:

Job Board Tax Avoidance Scheme

Gift Aid Tax Avoidance Scheme

Land Tax and Stamp Duty Tax Avoidance Scheme

Small businesses involved in a known scheme must disclose the details. Each scheme has a specific number which must be included at the top of the tax return completed by the small business. This is part of the Disclosure of Tax Avoidance Schemes (DOTAS).

HMRC takes a very dim view of anyone failing to disclose a scheme. For businesses that are part of a scheme fines can range from up to £5,000, while those who devised the scheme can face penalties of up to £1million.

According to Solution Loans, the best advice is transparency. If businesses aren’t sure, this guide is a good helping hand, while HMRC are always available to field any questions.

Ingrid Maldine is a business writer, editor and management consultant with extensive experience writing and consulting for both start-ups and long established companies. She has ten years management and leadership experience gained at BSkyB in London and Viva Travel Guides in Quito, Ecuador, giving her a depth of insight into innovation in international business. With an MBA from the University of Hull and many years of experience running her own business consultancy, Ingrid’s background allows her to connect with a diverse range of clients, including cutting edge technology and web-based start-ups but also multinationals in need of assistance. Ingrid has played a defining role in shaping organizational strategy for a wide range of different organizations, including for-profit, NGOs and charities. Ingrid has also served on the Board of Directors for the South American Explorers Club in Quito, Ecuador.