Roman Potemkin started the London-based company Trastra in 2017. He is the CEO of Trastra and has been in the FinTech business for more than 12 years.

Trastra’s main product is a Trastra Visa Debit card, which allows you to buy crypto credit card and lets users change their cryptocurrencies into EUR and back again. The people who have a Trastra card don’t need a bank account to turn their crypto assets into EUR.

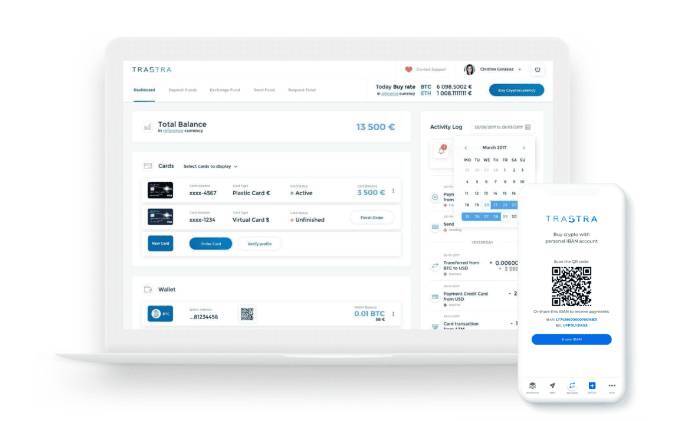

Trastra Solution

Once you sign up for Trastra, you will be able to access wallets for BTC, LTC, BCH, XRP, and ETH. It also comes with an IBAN account that lets users sell bitcoin with bank transfer(SEPA). Users can also instantly convert crypto assets to EUR and vice versa, buy cryptocurrencies with low fees using IBAN transfers, and use a Visa debit card.

Trastra gives its users the option to access their accounts from both the web and mobile apps. But only people in the European Economic Area can sign up for Trastra solutions right now because it is only available in that area. Trastra works with Bitcoin, Bitcoin Cash, Ethereum, Litecoin, and Ripple when it comes to cryptocurrencies.

App Trastra

Trastra lets you use a mobile app or a simple web app to manage your Trastra Visa Payment Card. The app or an IBAN transfer can be used to add money to a Trastra card. Users also get email notifications and notifications in the app when they use their card or account. If someone loses their card, they can turn it off right away using the Trastra app. Once they find the card, they can easily turn it back on from the app.

Trastra Fees

There are different costs to using Trastra. It includes fees for services, cards, and cryptocurrencies. Registration for an account, activation of 5 multi-crypto wallets, creation of a payment account, delivery of a card, and use of mobile apps are all free. Trastra cards have a €1.25 monthly card management fee and a €9 issuance fee.

Trastra doesn’t charge any fees for the cryptocurrency exchange or for buying cards in person or online. For both in-person and online purchases of non-Euro cards, cardholders will have to pay a 3% fee. Internal card-to-card transfers will cost €0.20, checking an ATM’s balance will cost €0.35, changing an ATM pin will cost €0.40, and getting money out of an ATM will cost €2.25.

If Trastra cardholders use ATMs outside the European Economic Area to get cash, they will have to pay a fixed fee of €2.25 and 3 percent of the amount they took out.

For crypto fees, Trastra users will have to pay a fee equal to 5% of the value of the buy order. There is also a standard mining fee for sending crypto to wallets outside your own. Users of Trastra don’t have to pay anything to deposit cryptocurrencies or exchange them for EURO. It’s also free to send cryptocurrency to Trastra’s internal wallet.

Locational restrictions

Users from the European Economic Zone are the only ones who can use Trastra. Because of this, only people from 31 countries can sign up for Trastra. These countries are Austria, Belgium, Bulgaria, the Czech Republic, Croatia, Cyprus, Denmark, Estonia, Finland, France, Germany, Greece, Hungary, Iceland, Ireland, Italy, Latvia, Liechtenstein, Lithuania, Luxembourg, Malta, the Netherlands, Norway. The countries of Poland, Portugal, Romania, Slovakia, Slovenia, the United Kingdom, and Sweden are also included.

If you reside in one of the 31 European Economic Zone counties and are looking to sell your bitcoins, Trastra is an excellent option. Overall, the Trastra card has pretty low fees if you plan to use it in EEA countries. But if you use it outside of the Eurozone, you might find that the fees are a bit high.

TechnologyHQ is a platform about business insights, tech, 4IR, digital transformation, AI, Blockchain, Cybersecurity, and social media for businesses.

We manage social media groups with more than 200,000 members with almost 100% engagement.