How to buy Ethereum: A beginner’s guide to buying ETH – Cryptocurrency has become a particular favourite for investors over the past few years and despite it’s rocky road, there are many digital currencies doing very well on the market including Ethereum.

If you’ve been thinking about investing into cryptocurrency, then Ethereum is likely to be a good choice when finding one of the best cryptocurrencies available.

In this guide, you’ll learn more about what Ethereum is and it’s origin. You’ll get the best advice on how to buy it and the benefits that come with investing in cryptocurrency.

So what is Ethereum and more importantly, how can you get started?

What is Ethereum?

How to buy Ethereum: A beginner’s guide to buying ETH – Described on the website of Ethereum itself, it’s a technology that allows you to send cryptocurrency to anyone in exchange for a small fee. Serving as an open access to digital money and data-friendly services, it’s a great platform to help invest in more variations of cryptocurrency, as well as Ethereum itself.

It’s a programmable blockchain that has a community-built technology behind it. Ethereum can help you use digital money without having to go through pavement providers or banks. As it’s programmable, you can use it for lots of different digital assets too.

What makes Ethereum unique is that it’s a marketplace for financial services as well as games and apps. As of now, the coin is worth nearly $3,000. It got its highest number of transactions in 2020, reaching one million daily. It’s certainly a popular cryptocurrency. Learn more by reading this Ethereum guide for beginners.

How to buy Ethereum

How to buy Ethereum: A beginner’s guide to buying ETH – So how do you go about buying and investing in Ethereum? Well, it can be helpful to break down the process in bitesize chunks, particularly if you’re not familiar with cryptocurrency in general, or even investing for that matter!

1. Get a wallet for Ethereum

How to buy Ethereum: A beginner’s guide to buying ETH – The first thing you’ll need is to get a wallet. As of 2021, there are 70.44 million blockchain wallet users worldwide. Before you can buy ether, you’ll need to buy or install a wallet. This will be the storage for your Ethereum or ether as it’s known for short.

It’s useful to know that there are a variety of wallets that can hold ether and deciding on which to choose is entirely up to you.

Like many investment opportunities, it’s always good to do your research and to explore the companies that provide these digital wallets. Here are a couple of examples that are some of the most popular for storing ether.

Trezor One

How to buy Ethereum: A beginner’s guide to buying ETH – Trezor is the oldest Bitcoin hardware wallet. It’s secure and provides a pin code that will never leave the wallet. So if you’re using a device that’s been compromised, the wallet itself won’t be affected.

Exodus

How to buy Ethereum: A beginner’s guide to buying ETH – For those who are beginners and haven’t used an ether wallet before, Exodus is a typical pick amongst others that are available. It’s a new one to the market but it’s compatible with Mac OS, Linux and Windows. There’s also a mobile app available for download so that you have the wallet with you wherever you go.

1. Buy ether from the right exchange

How to buy Ethereum: A beginner’s guide to buying ETH – Next up, you’ll want to buy the ether you invest in, from the right exchange. There are multiple exchanges available from peer-to-peer lending platforms, brokers and trading platforms.

Just like the digital wallet for your ether, it’s useful to look at the options to figure out which type of exchange will work best for you. There are several factors to consider, of which include:

- Fees involved with transactions from depositing to withdrawing.

- Countries the exchange is supported in.

- The types of payment methods accepted.

- The reputation and popularity of the exchange.

- Verification process and how long it takes to access the ether.

- Quality of customer support.

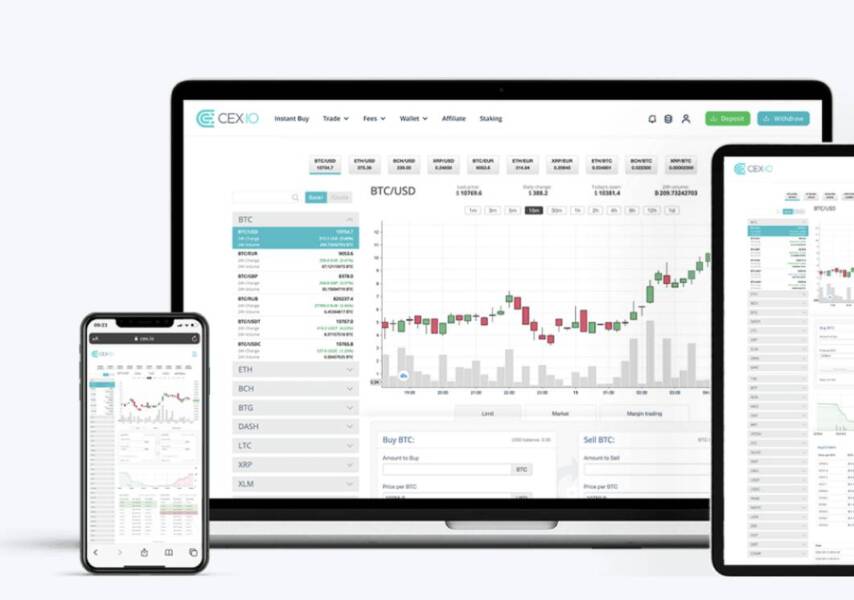

A few examples to look at would be Moonpay. With Moonpay, you can buy ethereum with a credit card, as well as many other cryptocurrencies. For brokers, the likes of CEX.io and Coinbase are worth looking at.

2. Transfer the crypto to your wallet

Finally, you’ll want to transfer any crypto into the secure wallet that you’ve set up. Whilst you can use the most secure wallets to store your ether, no crypto is entirely safe when it comes to the exchange or online wallet that you have.

It’s therefore important to know the risks and where possible, to transfer your ether to an offline wallet. As of January 2020, the amount of crypto-malware unleashed was 600 million, a figure that has likely risen since the pandemic and will do so beyond 2021.

The benefits of investing in cryptocurrency

How to buy Ethereum: A beginner’s guide to buying ETH – In general, cryptocurrency has become a type of investment that has cemented itself amongst other popular investment types. Cryptocurrency is more trusted than ever before and there are many more coin types popping up as the months and years go by.

There are certainly benefits to investing in cryptocurrency in general and not just ether.

Available to trade 24/7

Unlike other investments like property for example where trading hours may limit what progress you make, cryptocurrency operates 24/7. It doesn’t rely on opening hours and so there’s a lot more flexibility in when you can invest, when to buy and sell.

Due to no centralized governing of the currency, it’s proven to be very lucrative as a result.

Ability to invest long-term or short-term

How to buy Ethereum: A beginner’s guide to buying ETH – As the volatility of cryptocurrencies in general is up and down, there’s an opportunity for investing long-term or short-term. Depending on your needs as an investor, you can take advantage of a coin that’s dropped in market price to hopefully benefit from the bounce back it has.

With cryptocurrency, you can choose whether you want to keep your investment for the long run or you want to take advantage of it’s volatility.

Cryptocurrency volatility

How to buy Ethereum: A beginner’s guide to buying ETH – Speaking of this volatile market, it’s still relatively new. Despite that, it’s seen huge amounts of short-term interest. Some cryptocurrencies have remained stable in their rise or drop of value but the most popular option like Bitcoin went from highs of $19,378 to lows of $5,851 between October 2017 and October 2018.

It’s what makes this type of investment so exciting and it’s why many more investors are turning their attention to it. It’s a worthwhile addition to your investment portfolio.

Better liquidity

Liquidity is important because it provides better prices and faster transaction times. Liquidity refers to how quickly and efficiently a cryptocurrency can be converted to cash without impacting the market value.

Tips for managing your investment into Ethereum

How to buy Ethereum: A beginner’s guide to buying ETH – Having an investment is one thing but managing it is just as important. Whilst not all investments in your portfolio will need your undivided attention, some may require monitoring. Cryptocurrencies do require a bit of attention, so here are some tips for managing your investment.

1. Start small

It’s important to start small when investing in cryptocurrencies. Due to there being so many on the market, it can be challenging to know which ones are going to perform the best and that are also within your budget.

However, just because you can’t buy a whole coin, doesn’t mean the value of the investment isn’t going to be worthwhile. Start small and begin building up that coin amount, even if it’s by 0.005 at a time.

2. Keep an eye on your investment

Like any investment, it’s good to keep a watchful eye on how it’s doing. The cryptocurrency volatility might not be as extreme as the stock market but it can still drop significantly or rise significantly in a short amount of time. That’s because it’s a market that’s operating 24/7.

By checking in everyday or every other day, you can monitor how the currencies are performing and make decisions on whether to keep or sell from there.

3. Learn about hedging

Hedging is known as a type of investment strategy which can help reduce the potential risks that come with volatile price movements in a market like this one. It works by placing a primary trade in the direction you expect the market to go and a second trade in the opposite direction.

This is something you can do with cryptocurrencies by selecting two different cryptocurrencies, one that’s dropping in value and one that’s rising. The idea is that one will help cancel out the loss of the other.

4. Explore investment into other cryptocurrencies

Finally, don’t just limit yourself to Ethereum. It’s worthwhile exploring the rest of the cryptocurrencies available. There are lots to choose from and so it’s good to have a few variations in coins.

Look at the current top performers but pay attention to those further down the list too. You may find that some of the underdogs become the top performers in a matter of months.

Start investing into Ethereum

How to buy Ethereum: A beginner’s guide to buying ETH – Cryptocurrencies are a growing industry for investment and it’s becoming a more widely accepted form of currency. With that being said, it’s worthwhile investing in Ethereum where you can. Remember to do your research and know that you can start off small. That way, you can learn more about the cryptocurrency market and all that it has to offer.

TechnologyHQ is a platform about business insights, tech, 4IR, digital transformation, AI, Blockchain, Cybersecurity, and social media for businesses.

We manage social media groups with more than 200,000 members with almost 100% engagement.